That the Postal Service is seeking higher rates – significantly higher rates – is no longer breaking news. Nonetheless, some of what lies behind the front page remains consequential to ratepayers and, therefore, to commercial mail producers.

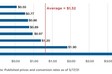

The proposed increase exceeds the total of the past five years’ price increases and represents the use of five forms of USPS “rate authority”:

* The CPI-based cap. Because it was less than a year since the previous filing, a different formula was used to determine the cap; the result was 1.244%.

* Banked. If the USPS doesn’t use all the available rate authority for an increase, the remainder can be “banked” for future use; that amount varied from 0.002% to 0.012%, depending on class.

* Density. This is one of the three new authorities allowed by a Postal Regulatory Commission decision last November 30. “Density” is meant to offset the loss of volume per delivery stop and is calculated annually; the amount available was 4.5%.

* Retirement. This second new authority was allowed to help raise money to make the payments to prefund future retiree health care costs (the USPS hasn’t been able to make any for a decade). This amount, calculated annually, was 1.062%.

* Non-compensatory. This final new authority is to catch-up those classes and categories (like Periodicals and some flats) that aren’t covering their costs; that amount is a flat 2% and applies only to those “underwater” products.

| Class | CPI | Bank | Density | Retirement | Noncompensatory | Total |

| First-Class | 1.244 | 0.012 | 4.500 | 1.062 | n/a | 6.818 |

| Marketing | 1.244 | 0.010 | 4.500 | 1.062 | n/a | 6.816 |

| Periodicals | 1.244 | 0.002 | 4.500 | 1.062 | 2.000 | 8.808 |

| Pkg Svcs | 1.244 | 0.006 | 4.500 | 1.062 | 2.000 | 8.812 |

| Special Svcs | 1.244 | 0.007 | 4.500 | 1.062 | n/a | 6.813 |

Despite being told repeatedly that increasing prices while businesses (and business mailing) are still recovering from the pandemic, and while service remains sub-par, was far from ideal, PMG Louis DeJoy plowed ahead, eager to use the new authority available to the USPS, as part of his 10-year Plan to improve the agency’s financial condition.

The PRC has 90 days to deliver a decision after reviewing the USPS filing, related documents, and public comments; that means August 28, and the Postal Service intends to implement the rates on August 29.

There are changes other than simple price increases that reflect rate design decisions and “signals” to mail producers. The Postal Service explained some of these in its filing:

* Rates for automation Presorted First-Class Mail letters rose more than those for nonpresorted single-piece rate letters. “Despite an overall decline in First-Class Mail volume, Automation Letters volumes have been steadier – over the last four years, they have declined at only about one-third the rate of Single-Piece Letters.” To the USPS, that meant a promising source of revenue.

* The USPS subdivided the prices for nonautomation Presorted First-Class Mail letters “that essentially aligns these products with the corresponding Marketing Mail structure by differentiating presort levels.” The Postal Service “notes that it intends for this rate restructuring to incentivize greater presortation by mailers.”

* Despite trying to encourage presortation, the agency also seems to be discouraging the application of barcodes. It set the same price ($0.461) for both AADC presorted machinable letters and AADC presorted automation letters, leaving some to wonder how such a pricing strategy supports barcoding. Prices for lighter First-Class Mail flats, both retail and presorted, also rose more sharply than for heavier pieces.

* For Marketing Mail, increases were lower – and sometimes below the class average – for the more finely presorted levels, and the High Density category was divided based on pallet level. “[T]he Postal Service notes that it is establishing this discount because pallets prepared this way allow the Postal Service to avoid moving these pallets to bundle sorters within the plant, sorting the bundles, and moving them back to the dock to be transported to the Destination Delivery Unit.”

* Again looking to optimize revenue where it could, the USPS raised rates higher than average for High Density presorted letters and flats, noting that “the increases represent an application of price cap authority to mail products with stable or increasing volume, which both Marketing Mail High Density Flats and Letters have had for years prior to the pandemic.”

* Especially for carrier route and most flats, the percentage increase for nonprofit Marketing Mail was generally greater than for the corresponding commercial rate cells.

* Price changes for Periodicals were greater in the piece rates for both in-county and outside-county pieces than in the pound rates. The advertising pound rates were equalized across zones, resulting in sharp increases for closer zones and sizable decreases for farther zones; the USPS claimed this was to improve cost coverage.

* Changes for bound printed matter rates varied widely, with prices for both retail and presorted flats being equalized across zones, and below average price increases were common for BPM parcels.

The takeaways from all of this – how individual customers will react – can be confusing, but some generalizations may be applicable:

* No client had budgeted for a mid-year increase in postage costs, so their fixed budgets may result in fewer pieces being produced, though commercial mailers can work with clients to develop smaller, lighter pieces with lower per-piece costs.

* Presorters may want to model clients’ typical mailings to determine if the Postal Service’s strategies will result in a shift in presort level or fewer automation (barcoded) pieces, considering overall list/address and data/production costs.

* The USPS did not disclose its plans for future increases, enabling worried speculation about another rate filing in August (for the usual January implementation) or a repeated large increase in mid-2022.

* The looming service standard change (for First-Class Mail and some Periodicals), combined with the sizeable price increase coming in August and the ambiguity of future service and prices may be the last straw for some clients already primed to leave the mail. Such an incentive is especially significant for financial clients (e.g., banks and credit card issuers) sensitive to both service (billing and payment) and mailing costs, so their commercial mail production providers may want to examine strategies to improve presort, use drop-shipment, or develop lighter mailpieces.

Given these circumstances – USPS service and prices, and the concurrent increases of other costs like paper and employee compensation – encouraging clients to stay in the mail, let alone increase their use of it, will be a challenge for commercial mail producers – though the result of not taking effective action likely would be worse.

Leo Raymond is Owner and Managing Director at Mailers Hub LLC. He can be reached at lraymond@mailershub.com.